Understanding the FERS SupplementRules for Special Provisions Federal EmployeesThe FERS Supplement is an important benefit for FERS planning to retire before age 62. Since so many Special Provisions (ATC, LEO and FF) federal employees retire before age 62, it’s important to understand who gets the Supplement and how it is calculated. The Supplement also has a few unique rules for Special Provisions FERS employees – and we’ll talk about those shortly. The FERS Supplement is also called the Special Retirement Supplement or SRS. In the federal retirement planning classes I teach, we call it the FERS Supplement or just the Supplement. It is designed to help bridge the money gap for certain FERS who retire before age 62. It will supplement your missing Social Security income until you reach age 62. But not all FERS are eligible to receive the Supplement. Rules of Eligibility for FERS SupplementTo get the Supplement, you must meet two qualifications… Let’s look at these qualifications more closely… Forgive me if the first requirement sounds too obvious – but people really do ask. Yes, the FERS Supplement is only for FERS. The Supplement is unique to FERS – there is no counterpart to the Supplement in the Civil Service Retirement System (CSRS). The second requirement is that you must have a normal immediate retirement. For Special Provisions, this means you must… Have 25 years of creditable service under Special Provisions and be any age If you do not have enough years of creditable service under Special Provisions (‘good time’) – then you can still qualify for the Supplement if you retire under the regular FERS immediate retirement rules. For a regular FERS immediate retirement, you must have… 30 years of creditable service and be at least your Minimum Retirement Age (MRA) or 20 years of creditable service and be at least 60 years old. And while you can seek a normal FERS immediate retirement at age 62 with 5 years in service – the FERS Supplement is only paid until age 62. So if you retired at 62 with 5 years of service, you would not get this benefit. Estimating the FERS SupplementThe calculation for the FERS Supplement is extremely complex and time-consuming. If you’re interested in an exact calculation, check out the OPM CSRS/FERS Handbook,

Chapter 51, Retiree Annuity Supplement

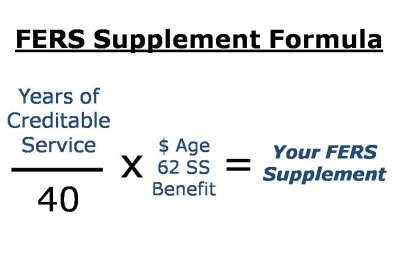

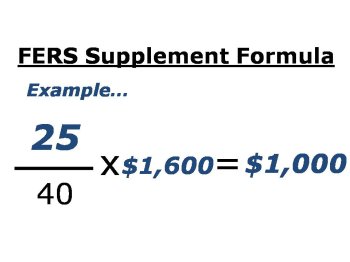

In order to estimate your Supplement amount, you’ll want to have your annual Social Security statement handy. You’ll also need to know how many years of creditable service you would have at your estimated retirement. The estimate formula is…

While you must have enough ‘good time’ to qualify for a Special Provisions retirement – if you have additional years of regular FERS creditable service, you can include those years here too. 40: this is a fixed number and does not change Your Age 62 SS Benefit: You’ll find this number on page 2 of your Social Security statement. And it doesn’t matter what age you plan to start receiving Social Security – for this formula, you must use the age 62 Social Security benefit amount. You can see that almost by design, the Supplement will be less than your Age 62 Social Security benefit. Unless, of course, you have 40 years of service. But that would be rare for Special Provisions FERS. Example of FERS Supplement CalcuationLet’s walk through an example together. Say John has 25 years of creditable service under Special Provisions (‘good time’). Because he has 25 years of ‘good time’, John can take an immediate Special Provisions retirement, even though he is only 48 years old. John’s Age 62 Social Security Benefit is $1,600 a month. Approximately how much will John’s FERS Supplement be?

But we’re not done quite yet. This is an estimate of the gross amount of the Supplement – but we need to look at the net amount John will receive. And many FERS who receive the Supplement are subject to a specific reduction. Reduction in FERS SupplementThe Supplement is treated much like Social Security Income. And if you take any Social Security income (or the Supplement) before your full Social Security Age (which varies from 65 to 67 depending on the year you were born) your Supplement is subject to a reduction and possibly taxes. The reduction is significant and because the income threshold is so low, it will impact many FERS retirees. This reduction is particularly important for Special Provisions FERS. Since many Special Provisions employees often get full or part-time jobs after their federal retirement. If you will have earned income (ex: a part-time job) after you retire from Federal service, your Supplement may be reduced. In 2011 the earnings limit is $14,160. What counts toward that limit? Earned income – which is essentially any income you receive as a W-2 wage or as self-employement income. (Technically, this is any income that is subject to Social Security taxes. If you have questions, a good financial planner should be able to assist you) So if you earn more than $14,160, your Supplement will be reduced. For every $2 you earn above the limit, your FERS Supplement will be reduced by $1. Example of Reduction to FERS SupplementLet’s go back to our example with John. Earlier, we estimated John’s gross FERS Supplement to be $1,000 a month. Let’s say John gets a part time job after his federal retirement – and that job pays him $30,000 a year. His $30,000 income exceeds the $14,160 limit by $15,840. If we take half of this amount, we get $7,920 – which is the annual reduction. Divide that by 12 and we get a monthly reduction of $660. $1,000 – $660 = $340 monthly FERS Supplement Ouch. And what if John got a higher paying job? Maybe he gets a full time job after his federal retirement – and that job pays him $50,000 a year. John’s full time job of $50,000 a year exceeds the $14,160 limit by $35,840. Half of that is $17,920 – which is the annual reduction. Divide that by 12 and we get a monthly reduction of $1,493. $1000 – $1,493 = …. $0 If your reduction is more than your FERS Supplement, you simply forfeit your entire Supplement. But – you need to know about a special rule for Special Provisions FERS… *Special Rule for Special Provisions*There is a special rule for Special Provisions retirees, when it comes to the earnings reduction. If you leave federal service on a full and immediate Special Provisions Retirement – you will not be subject to the earnings reduction until you reach your regular FERS Minimum Retirement Age (MRA). But, once you reach your MRA – the earning reduction comes into play. Going Back to Our Example…Let’s go back to John. John had 25 years of ‘good time’ and took a Special Provisions Retirement at age 48. John’s regular FERS MRA is age 56. We’ll say John gets a part-time job after federal retirement. That job pays him $30,000 a year. And for the sake of an easy example, let’s say he gets paid $30,000 a year, every year in retirement. John’s Supplement will be about $1,000 a month from his federal retirement, up until he reaches his MRA of age 56. But once he reaches his MRA, age 56, the earnings reduction will come into play. At age 56, John’s Supplement would be reduced by about $660 a month (see part-time work example above) – leaving John with a FERS Supplement of $340 a month. Now – we still need to cover one more area… Taxes… Taxes and the FERS SupplementWhen we discuss the Supplement in the Federal Retirement classes I teach, some people say, “If the government already reduced my FERS Supplement – surely they can’t tax it too.” Well, sorry – they can – and they do. But this tax is only for the so-called “wealthy”. When I mention this in class, a lot of people in the class sit back and relax – but then sit straight up in their chair when I tell them who the IRS considers to be “wealthy”. The IRS defines wealthy as having a combined income (for Married Filing Joint) over $32,000. Yes, $32,000. And combined income includes the sum of your adjusted gross income from your 1040 plus non-taxable interest plus one-half of your Social Security benefits. So now it’s not only your earned income that is considered – it is all of your income – including your regular FERS pension, any TSP withdrawals, investment earnings, Alaska PFD, alimony, etc. etc. etc. If you’re combined income is over $32,000, but below $44,000 – 50% of your FERS Supplement is subject to Federal income taxes. If you have a combined income greater than $44,000, then 85% of your Supplement will be subject to Federal income taxes. Mind the Gap: FERS Supplement to Regular Social SecurityThe FERS Supplement will stop the month you turn age 62. And it stops whether or not you have started drawing Social Security at age 62. Some people may choose to start drawing Social Security at age 62 – but others will want to delay until later. Why delay? The longer you wait, the higher your benefit will be. That is, up until age 70. The amount will not increase if you wait any longer than age 70 to draw Social Security. But if you delay drawing Social Security to get a larger benefit – it means you have to go that many more years without the monthly benefit. This can create a money gap – and it’s important to plan ahead for it. Everyone’s personal financial situation is unique – so you’ll want to carefully weigh your financial plans to see when it makes the most sense for you to start drawing Social Security. A good financial planner can help you understand your options and help you make the best choice for your personal situation. |